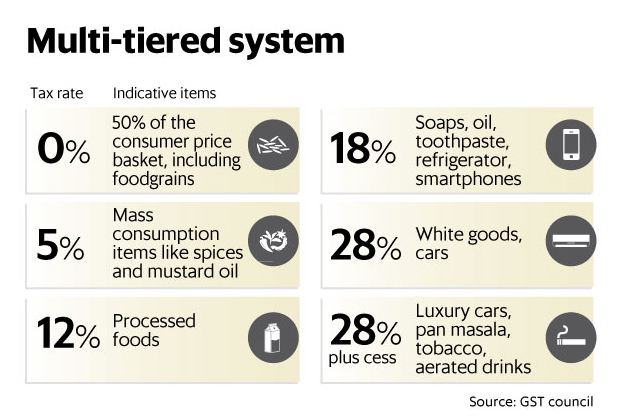

Goods and Services Tax (GST) Bill has been stirring storms and spewing debates over its impact on restaurants and its customers. As per the final proposed GST Bill, a four-tier GST rate structure- 5%, 12%, 18% and 28% has been set, where tax is levied at multiple rates ranging from 0 percent to 28 percent. Essential items including food, which constitutes about half of the consumer inflation basket as well as major foodgrains have been exempted from the GST and will be taxed at zero rates. As per the recent update from GST Council, the new GST Rate in India is fixed to be 5% for all Restaurants. Read in detail all you need to know about the GST Bill and how it impacts the restaurant business here.

GST Rate Structure for Restaurants in India

While it was earlier said that the impact of GST seems to be neutral on the restaurant industry, with the tax at consumer end coming down from 30% to the standard rate of 5% and the withdrawal of Input Tax Credits(ITC), it seems to affect the restaurant industry in a negative manner. Although dining out gets cheaper, but for restaurants, managing costs is becoming a herculean task.

Under the new GST rate structure announced by the Finance Minister Arun Jaitley, restaurants will be taxed on the basis of their turnover and whether or not the establishment is AC or Non-AC. Read how the new GST rates affect the restaurant business here.

Impact of GST Rate Structure on Restaurant Food Costs

The overall food cost of the restaurant kitchen has decreased under the new GST regime.

Edible oil, tea, coffee and spices which were taxed at 3%-9% have dropped to 5% while goods taxed at 9-15 percent are now taxed at 12%. Items that presently fall in the 15-21 percent range have dropped to 18%, thus affecting the overall food cost.

The GST rate structure is lower than the previous tax rates with items of mass consumption such as foodgrains taxed at 5% as opposed to the previous 6%, while processed food is charged at 12% as opposed to the previous 15%. Alcohol and aerated drinks that come under the Luxury category will also attract an additional cess along with the tax of 28%.

Alcohol falls under the State Tax and Excise, and is hence outside of the GST. However, the impact of the GST may still cause the price of alcohol to shoot up.

Food cost, on an average, represents 25-40 percent of the restaurant cost which is followed by labor cost that represents about 25-35 percent. There is no other cost in the restaurant cost structure as high as the food cost; hence, restaurants should aim at keeping their food cost between 28-35 percent of their total operating budget. Hence, a reduction the food cost is likely to benefit the hospitality industry.

Impact of GST Rate Structure on Restaurant Bills

The GST rate structure spells good news for the restaurants as the multiple taxes have been removed, resulting in reduced bills. Cheaper bills are sure to attract customers and would result in an overall increase in business.

“The restaurant industry has been burdened with high and multiple taxations. NRAI has been advocating for reduction/simplification of the same. We welcome the Centre’s move for the introduction of this much-awaited reform.” – Riyaaz Amlani, president, National Restaurant Association of India.

a uniform 5% tax Structure on Both ac & NON-AC Restaurants will definitely help in rationalising the tariffs across restaurants in India. but the restaurant sector seems discontent with the withdrawal of Input Tax Credit(ITC) As the costs will go up.

Stay tuned for more updates on how the GST bill affects restaurants.

hi

Hi,

Great Post, I say great because of the info which I got through write up of how GST is impacting the food industry, the taxed levied on different type of goods.

Thanks for sharing a knowledgeable post on GST.

Keep up the good work!!