Getting a bank loan isn’t an easy process. Be it a two-wheeler loan, car loan, home loan or a business loan. Any loan consists of a tedious process such as collection of financial documents, personal details, and verification. In this article, we will take you through the step by step approach to getting a bank loan for restaurant business with or without guarantee. Yes, you can secure a bank loan with no minimum guarantee or collateral guarantee. Find out more about the investment needed to open various restaurant formats here.

Things You Need to Secure a Loan for Restaurant Business

The Ministry of Small Medium Enterprise has come up with the solution for the next generation talented entrepreneurs who have an ambitious business plan under Credit Guarantee Fund Trust for Micro and Small Enterprises popularly known as CGTMSE Scheme. Read below to know the things you need to secure a loan for restaurant business.

1. Form a Business Entity

First and Foremost step is to select the format of food business which will decide the kind of business you want to pursue and the investments you require. Based on the restaurant format and ownership, the person should get his/her company registered in any of the forms – Private Limited, Private Partnership or Sole Proprietorship. Post registration and getting a legal approval of starting a business one should make the solid business plan.

2. Create a Business Plan

Preparing a business plan isn’t the easy step, it is advised to take professional help to prepare a business plan. The business plan should have a Vision, Mission, Business Model, and Financial forecast. Based on your business plan the bank approves or disapproves of the business loan application. So, the business plan is the most important document of all other documents required for a business loan for a restaurant.

3. Obtain a Bank Loan Sanction

After completing the business plan, you must compile all the financial documents in the file to secure a loan for your restaurant business. The following documents are required:

(a) Profile of the loan applicant

(b) Income Tax Return of the last three years (Personal or Business firm)

(c) PAN Card and ID/Address Proof

(d) Documents of Collateral (Property or Fixed Deposit papers).

If the loan is not covered under CGTMSE Scheme below are the pre-requisite to get the loan.

(i) Primary-Hypothecation: In this borrower pledges an asset as collateral for a loan, while retaining ownership of the assets and enjoying the benefits therefrom.

(ii) Collateral Documents: For loan Up to Rs.10 lakh- Nil subject to coverage under CGTMSE Scheme. Above Rs.10 lakh- EM of immovable property (premises of Hotel / Catering Unit) equivalent to 100% of the loan amount.

In case third-party properties are offered, a guarantee of the third party shall also be obtained. After proper verification of documents, the bank may sanction the loan for your restaurant business subject to your eligibility.

Tip: It is advised to apply for your business loan where you already have an account or have a long-standing relationship with the bank.

4. Getting loan under CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

Once the bank loan is sanctioned, the bank will further apply to CGTMSE scheme cover at CGTMSE organization. After the approval, the loan seeker or borrower will pay CGTMSE guarantee and service fee.

Frequently Asked Questions (FAQ) about Securing a Loan for Your Restaurant

The following are the FAQs that will help you get a better understanding of getting a bank loan for your restaurant business.

a) How much loan can you get under this scheme?

From Rs 5 lakhs to Rs 1 crore based on the requirement.

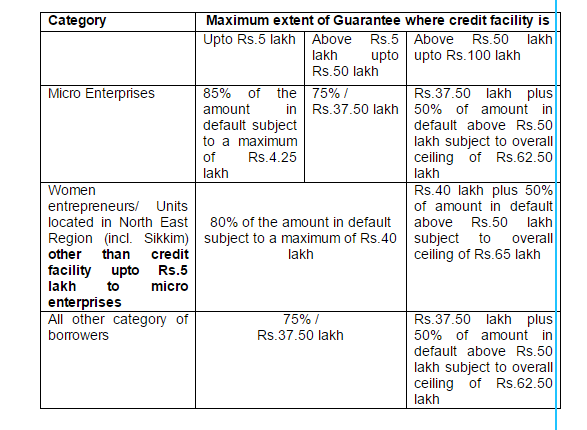

Of the credit facilities extended by MLIs, Trust shall guarantee, in case of default by the borrower, up to 75 percent (85% for select category of borrowers), of the defaulted principal amount in respect of term credit including interest on principal for one quarter and / or outstanding working capital advances (inclusive of interest), as on the date of account becoming NPA, or as on the date of filing the suit, whichever is lower. Other charges such as penal interest, commitment charge, service charge, or any other levies/ expenses shall not qualify for the guarantee cover.

c) What is the Loan Tenure?

(i) Based on the bank and its terms the loan tenure can be a maximum period of 5 to 7 years for the term loan.

(ii) One year for the working capital which can be renewed on a yearly basis.

d) What should be a personal contribution to the total investment?

(i) 25% of the total investment for Kitchen equipment/Furniture & fixtures.

(ii) 35% of the total investment for purchase/construction/

e) What is the rate of interest?

Average 11 percent -13 percent depending on the bank.

f) Who are all eligible for the loan?

(i) Midsized hotels / restaurants/bakeries/fast food outlets/motels/Highway inns /kiosks /mess /canteens.

(ii) Units in own premises/units in leased premises with an unexpired lease covering the repayment period.

(iii) Units having a valid license to conduct Hotel business/Catering from Municipal/Local Administration

(iv) New Startups

Click Here or download to read the complete scheme of Credit Guarantee Fund Trust for MICRO AND SMALL ENTERPRISES.

List of Banks Providing a Business Loan Under the CGTMSE

You can approach the following banks to get a loan for your restaurant business

1. SBI

2. Vijaya Bank

3. Indian Bank

4. Axis Bank Limited

5. Andhra Bank

6. HDFC Bank

7. ICICI Bank

8. Induslnd Bank

9. IDBI Bank

10. Yes Bank

Apart from the Banks, several new Fin-tech startups have come up that provide a loan to restaurants and food businesses. Find out how to secure a loan and get funding from these Fin-tech companies for your restaurant here.

We hope you have garnered a comprehensive understanding of how you can secure a bank loan for your restaurant business that will help you keep the financial troubles at the bay and augment your restaurant operations immensely.

I want to start resturant with hukka bar

For a restaurant owner having a steady source of funding is more significant than ever before. The growing costs of essentials required on a daily basis, the increase in logistics expenses and wages for skilled hire are a few reasons why you might require small business loans for restaurants. The article above is very comprehensive and well explained. I especially like the content under Create a Business Plan. Good Read.

Many newcomers find it difficult to procure a loan for starting restaurant. This article is very detailed and is very helpful. Thank you for breaking down the entire process.

Getting a loan for restaurant startups has become quite easy nowadays thanks to the Fintech companies.

hello, tej here i need guidance I’m looking to start pub in Pune …! will you plz help me out ?

Starting a restaurant involved a huge investment. Hence, many a time, restaurateurs prefer to take a loan to start their restaurant business. This article provides some very useful insights on how to secure a loan to start a restaurant. Great work!